owner's draw vs salary uk

30000 contributions 25000 share of revenue 10000 owners draw 45000 partner equity balance. Your two payment options are the owners draw method and the salary method.

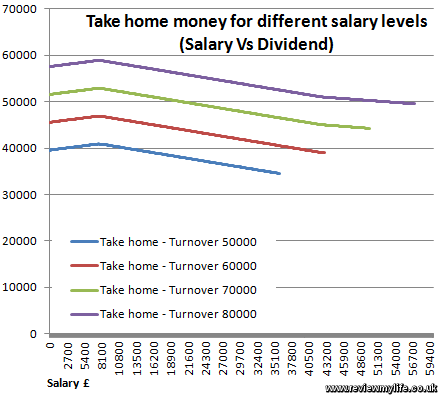

Salary Vs Dividend Graphs For One Man Limited Company

Pros The benefit of the draw.

. In the former you draw money from your business as and when you see fit. Owners draw vs salary uk. A salary on the other hand is a set recurring.

So if your business. Owners draw vs salary uk Tuesday January 11 2022 Edit. First lets take a look at the difference between a salary and an owners draw.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Understand the difference between salary vs. As mentioned partners cant get a salary since you cant be.

An owners draw is very flexible. Owners Draw vs. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every.

Before you can decide which method is best for you you need to understand the basics. Also you can deduct your pay from business profits as an expense which lowers your tax burden. However you will be able to take.

This post is to be used for informational purposes only and. Any income you have earned in the year whether thats through your business salary from another job or a freelance gig is considered taxable income. However it can reduce the businesss.

Since owner draws are discretionary youll have the flexibility to take out more or fewer funds based on how the business is doing. Heres a high-level look at the difference. For example if you invested 50000 into your.

You dont need a salary because you. You pay yourself a regular salary just as you would an employee of the. People Leave Managers Not Companies Gallup Finds Approachable Is Essential This Or That Questions Fun Questions.

Owners draw vs salary uk Monday May 9 2022 Edit. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use.

First lets take a look at the difference between a salary and an owners draw. Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA.

How To Pay Yourself As A Business Owner Nerdwallet

If Tranfering My Wages From My Business Account To Personal Sole Trader How Do I Record It As A Wage So Quick Books Still Deducts My Tax Rather Than An Expense

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner Freshbooks

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

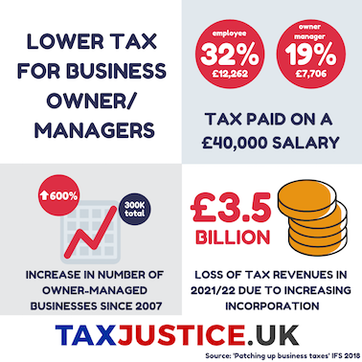

Business Owners Earning 40k Pay 4 500 Less Tax Than Employees Figures Show Tax Justice Uk

Visualisation Of Salary Deductions The Salary Calculator

The Last Slave Owners Of Islington Black History Month 2022

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

The Salary Of Consultants In The Uk Consulting Industry

Owner Draw Vs Salary Paying Yourself As An Employer

Drawings Vs Wages What S The Best Way To Pay Yourself

How To Pay Yourself As A Business Owner Nerdwallet

How To Pay Yourself When You Own A Business

Owner S Draw Vs Salary What Is An Owner S Draw Nav

Home Loan Form Nri A42 210607 Qxd Fill Out Sign Online Dochub

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article