rhode island tax table

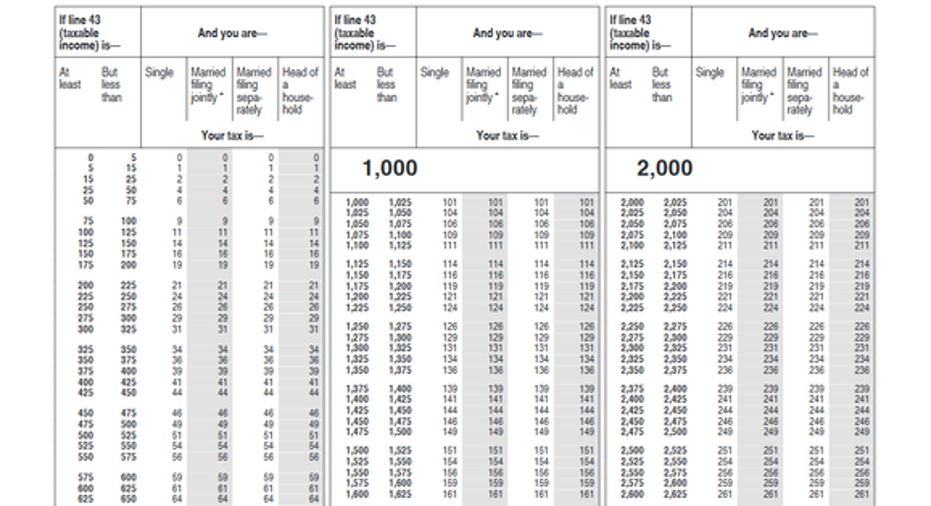

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Find your pretax deductions including 401K flexible account.

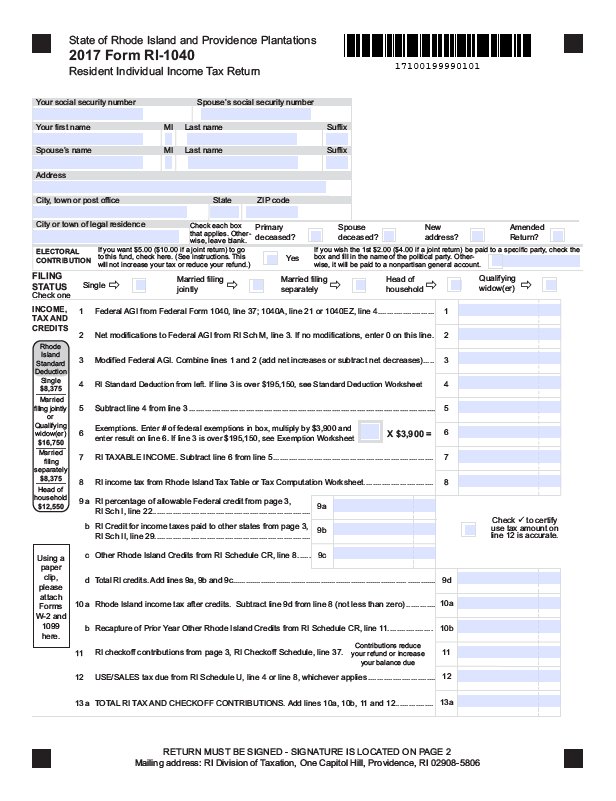

Rhode Island Division Of Taxation 2019

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet.

. Across all states and the District of Columbia. Detailed Rhode Island state income tax rates and brackets are available on. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. Download or print the 2021 Rhode Island Tax Tables Income Tax Tables for FREE from the Rhode Island Division of Taxation. 2022 Rhode Island Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Rhode Island Cigarette Tax Rhode Islands tax on cigarettes is the fourth-highest in the US. Rhode Island Income Tax Rate 2022 - 2023. This form is for income earned in tax year.

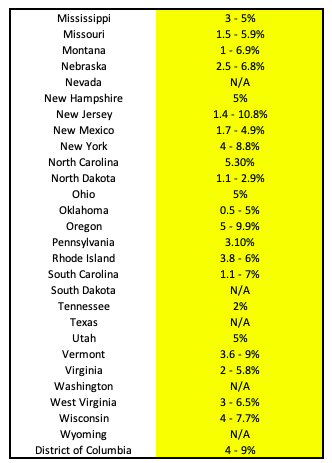

2022 Rhode Island Sales Tax Table. Rhode Island Tax Brackets for Tax Year 2021. Rhode Islands 2022 income tax ranges from 375 to 599.

How to Calculate 2022 Rhode Island State Income Tax by Using State Income Tax Table. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. More about the Rhode Island Tax Tables.

Income tax tables and. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

Find your income exemptions. The tax is 425 per pack of 20 which is. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. Compare your take home after tax and estimate. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. Any income over 150550 would be.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. 2022 Rhode Island Sales Tax Table.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

How To Set Up An Llc In Rhode Island 2022 Guide Forbes Advisor

Rhode Island Tables Carbon Tax Plan Aopa

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

2017 Tax Tables What You Need To Know Now Fox Business

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Connecticut Income Tax Brackets 2020

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

How Do State And Local Sales Taxes Work Tax Policy Center

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

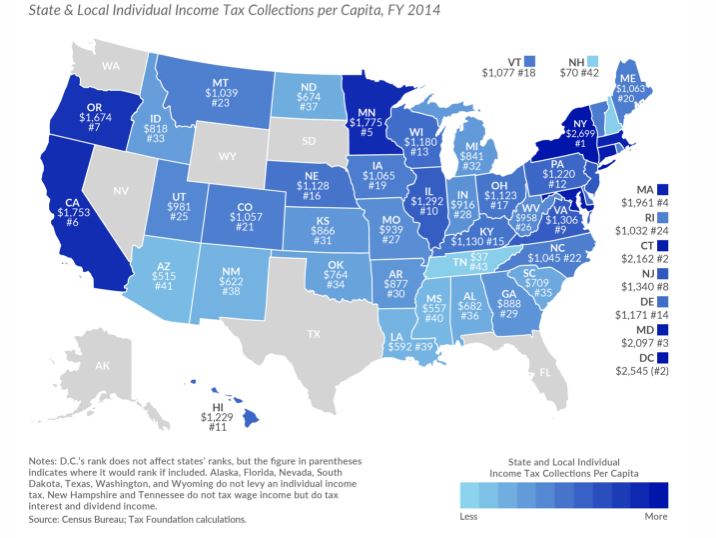

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

Rhode Island Division Of Taxation 2020

Rhode Island Income Tax Brackets 2020

Solved I M Being Asked For Prior Year Rhode Island Tax And It Says Enter Your 2019 Rhode Island Tax What Does This Mean Is This Asking For My 2019 Refund

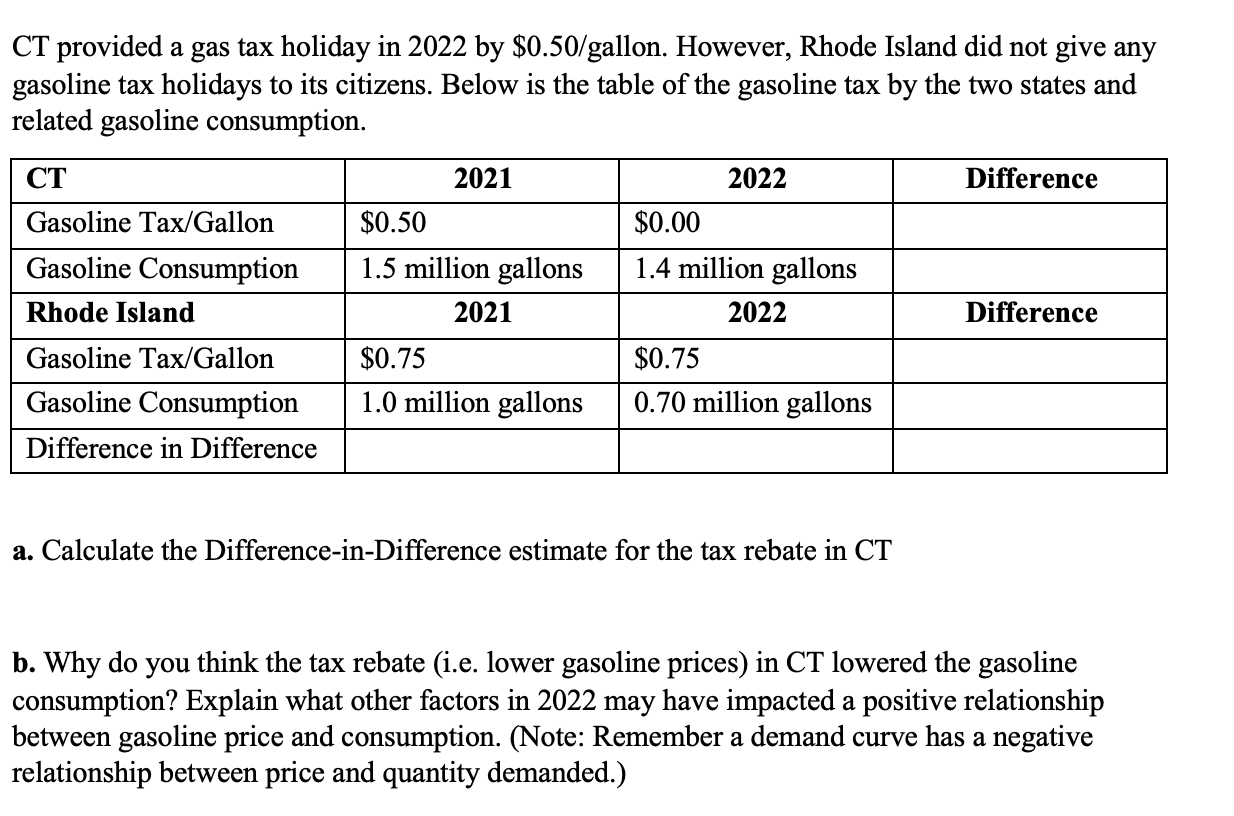

Solved Ct Provided A Gas Tax Holiday In 2022 By Chegg Com

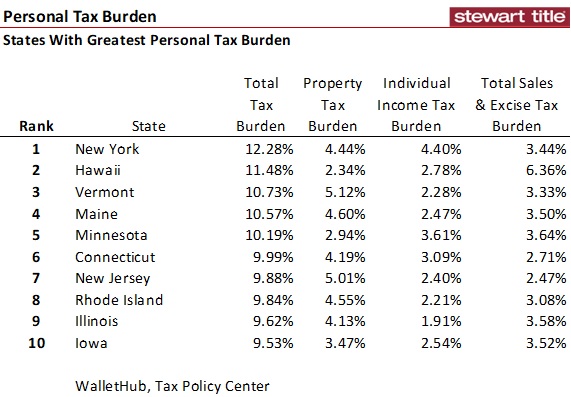

Another Top 10 List States With The Greatest And Least Personal Tax Burdens